Get a Business Loan TODAY!

Credit Lines up to

$2,000,000

Funds in as little as

4 hours

Fast, Flexible Business Loans to Power Your Growth

Simple Process. Easy Approval.

As Seen On. . .

Apply Online Now

Simple, no-obligation process done in minutes.

Get Approved (little as 4 hours)

Decision are quick, and NO hard credit check.

Direct Access To Funds

Withdraw funds immediately with your own online portal.

Grow and Repeat - Build Business Credit

Repay and repeat again and again as your business grows.

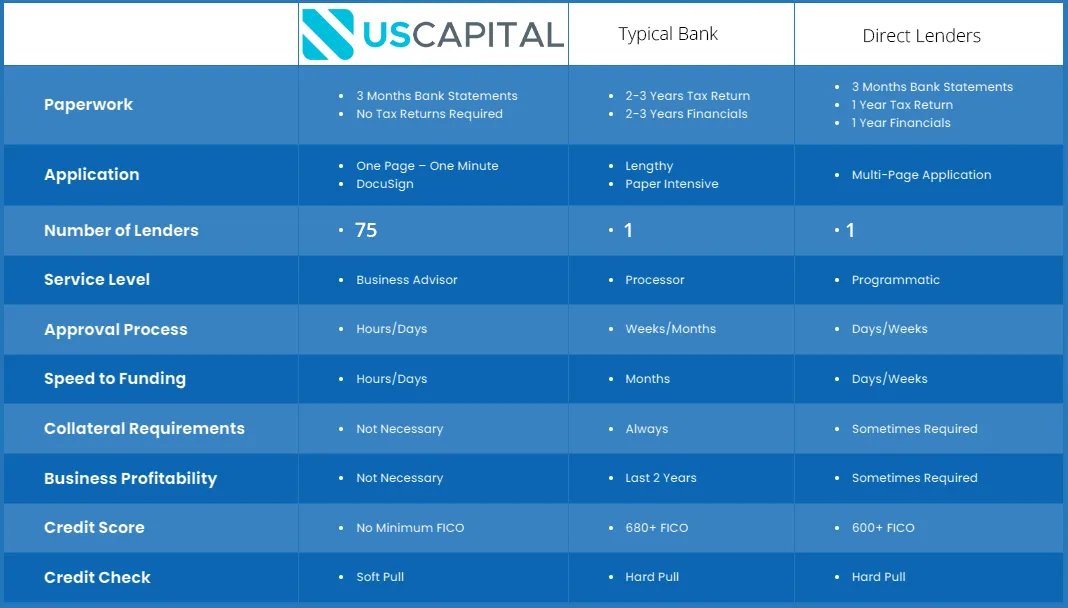

See For Yourself - US Capital Is the Best!

Apply Today. Get Funded Today.

Get the Capital Your Business Deserves

We understand that every business has unique needs. That’s why US Capital offers a full range of small business loans and commercial lending options to help you stay competitive:

Working Capital Loans – Access quick funding to cover payroll, marketing, or operations.

Equipment Financing – Purchase or upgrade essential tools without cash flow strain.

Business Line of Credit – Draw funds as needed and pay interest only on what you use.

Startup Business Loans – Flexible solutions for new and growing ventures.

Hard Money & Asset-Based Lending – Ideal for real estate investors and businesses needing short-term capital.

What types of business loans do you offer?

Borrowing amounts vary depending on your business profile and the product you choose. For example, you may qualify for a business line of credit up to several hundred thousand dollars or a term loan sized to purchase equipment or financing business expansion.

How much can I borrow?

Borrowing amounts vary depending on your business profile and the product you choose. For example, you may qualify for a business line of credit up to several hundred thousand dollars or a term loan sized to purchase equipment or financing business expansion.

What are your minimum eligibility requirements?

Typically, you’ll need an active business (often at least 1 year in operation), consistent revenue (for instance $100,000+ annual revenue), a business bank account, and the ability to provide recent bank statements. Credit score minimums may be flexible depending on product.

What are your minimum eligibility requirements?

Typically, you’ll need an active business (often at least 1 year in operation), consistent revenue (for instance $100,000+ annual revenue), a business bank account, and the ability to provide recent bank statements. Credit score minimums may be flexible depending on product.

How long does the application and funding process take?

After you submit your application online with required data, we aim to provide a decision quickly. In many cases, funds can be delivered in as little as 24 hours once approved, especially when documentation is complete and product fit is good.

Do you require collateral or a personal guarantee?

Yes. We offer flexible underwriting for business owners who may not have ideal credit. Rather than relying solely on credit score, we look at overall business cash flow, bank statements, revenue trends and other indicators of performance.

Can I get funding if my credit isn’t perfect?

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Are there fees or hidden costs I should know about?

All financing offers come with terms and any associated fees clearly disclosed. Typical costs may include documentation fees, late fees, or early-payoff terms. We believe in transparent lending—so you understand total cost up front.

How can I apply for a startup business loan if I’ve been in business for less than 2 years?

We have startup-friendly funding solutions designed for newer businesses. While requirements may differ (higher revenue thresholds, stronger cash flow, or co-signers), you still can access capital for growth, marketing, equipment purchase or working capital.

funding specialists ready to help

Talk to a lending advisor today

At US Capital, we understand timing matters when it comes to business growth. That’s why our experienced funding team is always standing by—ready to review your application, answer your questions, and help you secure the capital you need quickly and confidently. Our specialists guide you through every step of the process to ensure fast approvals, and reliable support from start to finish.

What You'll Need

Min. Qualifications

No Min. Credit Score Required

Min. 1 Year in Business

$100,000+ Annual Revenue

Needed To Apply

Basic Business Information

Business Bank Account

Or 3 to 4 Bank Statements

Get Started Now

Hours

Monday-Saturday

6am - 7pm (PST)

Get Started Now

Monday-Saturday

6am - 7pm (PST)

© US Capital 2025